IN Karnataka Form-5 free printable template

Fill out, sign, and share forms from a single PDF platform

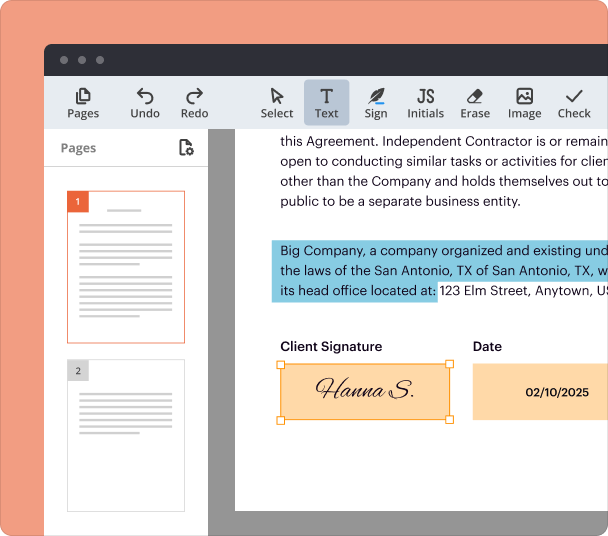

Edit and sign in one place

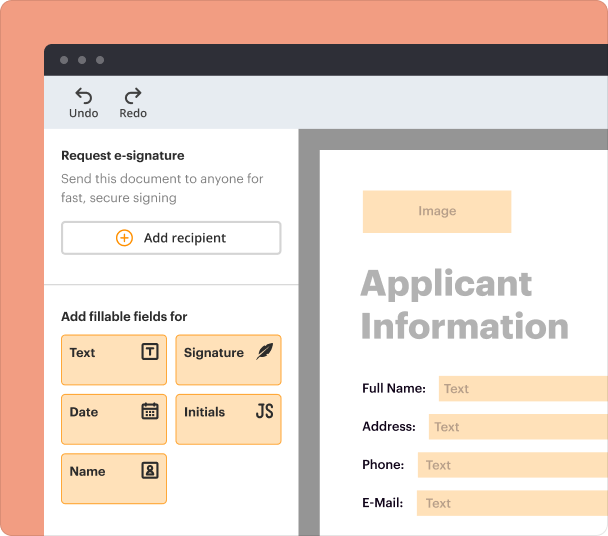

Create professional forms

Simplify data collection

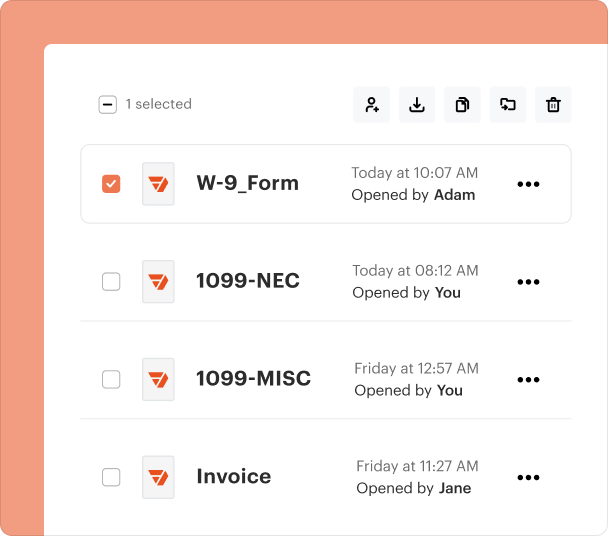

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Karnataka Form 5 Printable Form Guide

How does Karnataka Form 5 work?

Karnataka Form 5 serves an essential role in the annual profession tax returns for individuals and businesses in Karnataka. The form is utilized to declare the profession tax owed by employers for their employees. Understanding its requirements and submission process is crucial for compliance with the state’s tax laws.

Eligibility criteria for submitting Karnataka Form 5 include being an employer with employees liable to pay profession tax. Additionally, employers must ensure they maintain proper records deducing the correct tax amount. Many misconceptions surround the form, including the confusion about its necessity and who qualifies as an employer.

What is the structure of Karnataka Form 5?

Karnataka Form 5 is designed with a straightforward structure to ease the filing process. Each section is clearly delineated, detailing essential information like personal details, tax rates, and enrollment data.

-

This section requires the employer's name, address, and contact information, ensuring accuracy for tax purposes.

-

Employers must include the applicable profession tax rates for their employees in this section.

-

This part captures details about the business registration or enrollment with the state tax authority.

How do you fill out Karnataka Form 5?

Filling out Karnataka Form 5 involves several steps that require attention to detail. Start by gathering essential supporting documents, such as proof of employee wages and tax registrations.

-

Enter your personal details accurately in the designated sections to avoid delays.

-

Specify the tax rates applicable to your employees as per their salary brackets.

-

Check for common mistakes, such as incorrect GSTR numbers or tax rate calculations.

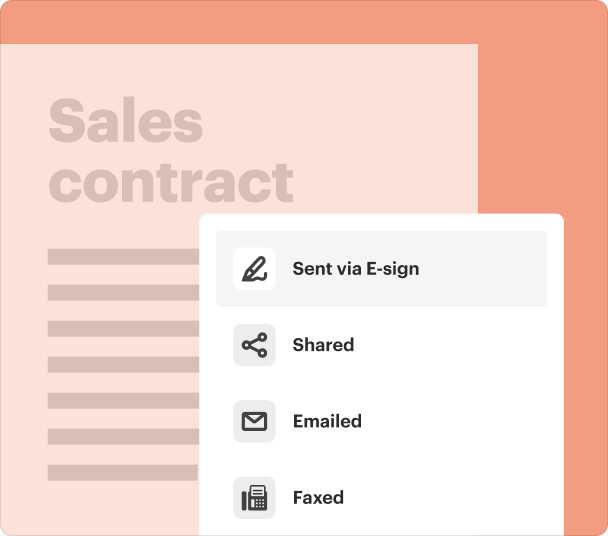

What are the submission methods for Karnataka Form 5?

Karnataka Form 5 can be submitted through both online and offline methods. The online submission is preferred due to its convenience and instant confirmation.

-

Employers can log into the official Karnataka tax portal to complete and submit their form electronically.

-

Printed forms can be submitted at designated tax offices, although this may lead to longer processing times.

A deadline for submission is mandated, typically at the end of the financial year. Late submissions can incur penalties, emphasizing the importance of timely action.

How does payment of tax through Karnataka Form 5 work?

Employers have several options to pay tax dues arising from Karnataka Form 5. Understanding these options can simplify compliance and help avoid penalties.

-

Employers can opt for electronic payment through the Karnataka tax portal or authorized bank websites.

-

Payments can also be made through physical bank branches handling tax payments with proper form submissions.

-

Failure to pay on time can lead to significant penalties, emphasizing the necessity for prompt payment.

Why choose pdfFiller for your document needs?

At pdfFiller, we provide extensive functionalities designed to simplify your experience with Karnataka Form 5. Our platform allows users to easily edit, sign, and store documents securely in the cloud.

-

Users can modify the form as needed without hassle, ensuring accuracy is maintained.

-

Our user-friendly interface supports document sharing and collaboration, making it ideal for teams.

-

Documents are stored securely, ensuring that sensitive information remains protected.

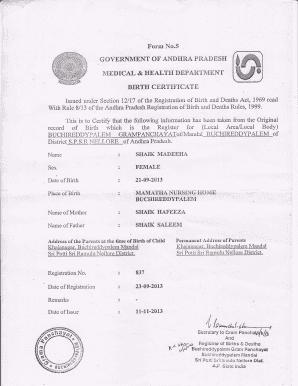

Frequently Asked Questions about birth certificate karnataka form

Who is required to fill out Karnataka Form 5?

Employers with employees liable for profession tax must fill out Karnataka Form 5. This ensures that relevant taxes are reported accurately for compliance with state tax regulations.

What are the common mistakes to avoid when filling out Karnataka Form 5?

Common mistakes include incorrect entry of tax rates, wrong business details, and failing to attach necessary documents. Double-checking information before submission can help prevent these errors.

Are there any exemptions for Karnataka Form 5?

Certain exemptions may apply for individuals or organizations under specific conditions, such as educational institutions. It's important to verify eligibility for such exemptions before filing.

What happens if I miss the submission deadline for Karnataka Form 5?

Missing the submission deadline can lead to penalties and potential legal repercussions. Employers are advised to submit the form on time to avoid these issues.

How can pdfFiller assist me with Karnataka Form 5?

pdfFiller offers tools for editing, signing, and securely storing Karnataka Form 5, facilitating smooth completion and management of the document with ease and efficiency.

pdfFiller scores top ratings on review platforms